Will’s Story – from

It all began when Granny died. She didn’t leave me a fortune, exactly – but enough to think that I had to do something meaningful with the money. Property was out, not enough for a deposit on a house. But definitely enough to put into an ISA (a tax-free way of investing in shares that exists in UK).

I started reading more and more about investing. The advice was the same across the board – don’t try to beat the market. Don’t invest in individual stocks. Just stick to plain old ETF’s; they have close to $0 fees, and will grow over time. If you’re a long-term investor and you want to retire someday with a nice pot, the best option is to invest a little monthly, and eventually your pot will grow slow and steady.

And it did kind of work – the ETF I had bought in the S&P500 grew pretty well over time. But not all my investments were as savvy. Hargraeves & Landsdown offered me the chance to invest early into a fund run by renowned fund manager Neil Woodford. It seemed like a great bet; this guy had a fantastic track record and promised outsized returns. I put most of granny’s money into that fund.

Then the proverbial hit the fan — Woodford’s fund went down hugely in value, and was found to have invested in less-than-stellar assets. Trading was suspended on the fund. There was a huge scandal, prompted by an investigation by the Sunday Times. I didn’t lose everything, but it was a significant haircut.

Fast-forward to the summer of ’22. My partner and I were living in Madrid that summer; an experiment to see if we could handle the August heat of one of our favourite cities. We’d decided to move to Spain from Mexico in order to get on track for EU citizenship, and most days we would try to stay indoors until at least 8pm, or scarper around like cockroaches between shady spots outside. I had time to chat to my friends back in UK.

A good schoolfriend was also disillusioned by the ETF and fund-investing game. His hero was now Warren Buffet and the school of value investing. The idea is simple enough — invest in undervalued stocks, and sit on them for the long term.

It involves digging deep into the data to understand the true value of a company. For my friend Joel, who has a background in buying and selling businesses, this is bread and butter stuff. But it involves a lot of work, and certainly more than I was willing to put in.

He mentioned something that made my ears prick up.

Buffett is quoted to have said that the options market has the biggest opportunity for mispricing. And someone smart could really take advantage of that.

I decided to dig a bit into Options trading and got sucked into a whirlwind of Youtube videos. My favourites to begin with were Trading with Davis, Henry, Market Moves, Tom King. They’re all (except King), Millennials like me who wanted to share their journey trading options.

I watched so many videos that I eventually grasped the concept. What I learned was that there are ways to construct trades within options that limit your risk and can produce cashflow in a relatively safe way. It didn’t seem as risky as I first thought.

I spoke to Joel after a couple of months of digging into options trading.

“If options are so powerful, why doesn’t Buffet trade them?” I asked.

“Will, Buffet’s shareholders would never allow it. Too much perceived risk. And besides, the size of Berkshire means that he’d never get the kind of volume needed to do it”.

Satisfied with the answer, I continued my quest.

I traded all sorts. Strangles on oil futures. Iron condors on Disney. The Wheel. Bear put spreads on Tesla and a variety of other trade constructions; all of which produced some winners, some losers. Overall I was making money.

But then another proverbial hit the fan — August `24 saw a huge spike in volatility after the “Japanese carry trade” collapsed. High volatility meant my naked puts all shot up in value, causing a margin call in my account. Basically my broker wanted me to close my positions or put more cash into the account.

I didn’t really have time to react. I also panicked. I closed most of my naked puts for a loss, and watched my account go deeper and deeper into the red. I took another big haircut on my account that day — this time, 25%. At the time, I thought I would lose everything, it was a scary day.

I vowed not to trade naked options. I was going to stick to a single trading style and be more disciplined about how much risk I was taking on.

I still had cash tied up in ETF’s — essentially I was trading stocks anyway. I decided that if I were going to put money into stocks anyway, I might as well sell covered calls on them.

The returns doing this would be better than just holding the shares; this is when I got interested in trading for income.

The idea is that instead of thinking about gaining on the underlying shares, I would sell the right to have the shares called away at a higher price in the future.

Let’s say you buy shares at $100 each. You give someone else the right to buy those shares at $102. Why would they want to buy that right from you? Because if the price goes up to say, $105, they want to benefit from that price increase. But they don’t want to put up the cash for the 100 shares. This is a cheaper way to get the option for profits.

The amazing thing about the options market is that you don’t need another individual buyer to take on that option. Market makers ensure that your order will always get filled, albeit not always at the best price.

I bought shares, and sold covered calls.

I also sold puts, acquired shares at a lower price and sold covered calls on them.

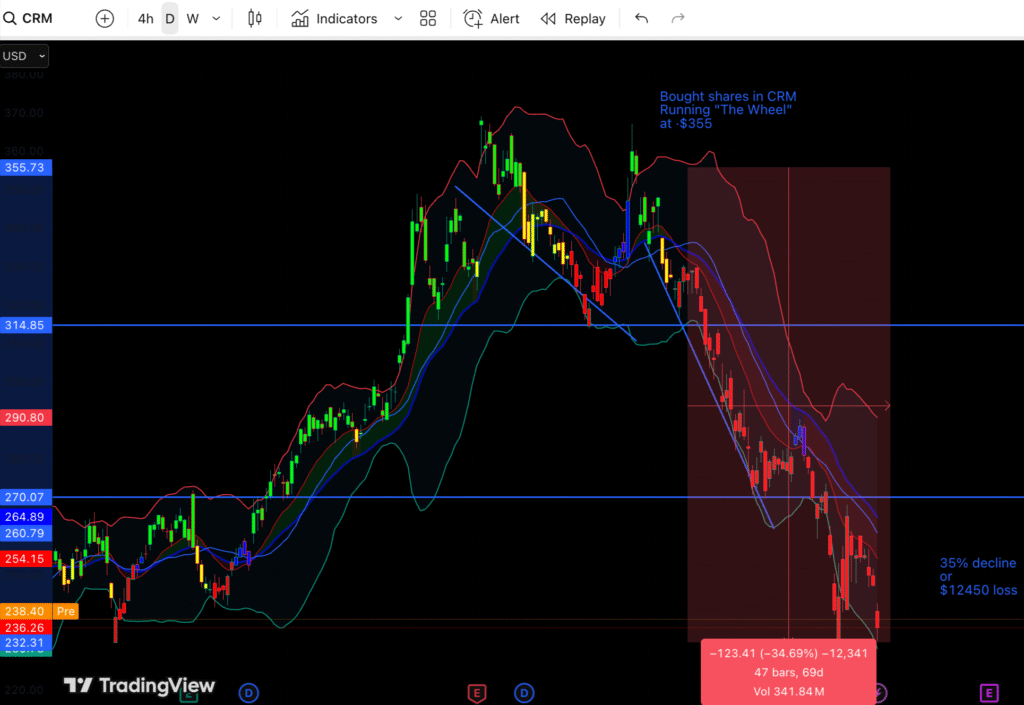

The problem was that buying shares is also pretty risky. My shares in CRM and a number of others plummeted, losing much more than I was able to recuperate in “out of the money” covered calls (the technique above).

As the market went down, I was losing big on those shares. I eventually had to cash them in, once again with my tail between my legs.

By this point I’d put all my spare cash into my trading account, reasoning that it would otherwise by tied up in shares in my ISA. My account went down by 30%.

I’d researched a trading style called Poor Man’s Covered Call during my obsessive Youtube phase but always thought the risk was too great.

The idea is that instead of selling a covered call on real shares, you sell them on a long call – basically you buy the right to own shares at a lower price at some point in future, and then sell the right to buy shares at a higher price. For a full explanation of the PMCC, view this video below :

My initial fear was that I could have no way of knowing whether a stock would be higher or lower than today’s price in a year’s time. No-one can know that. If my underling call went down in value (likely), I would be losing money.

But then I figured out the maths and realised that if I sold weekly calls against my long call, I would probably be able to pay off the long call in a matter of a few months, and then profit for the rest of the life of the contract.

I dug deeper and found other traders doing the same thing.

They called it the “Income Poor Mans Covered Call”.

Instead of worrying about the price of the underling call, hoping for it to go up – they were concentrating on the extrinsic value of the short calls. If the short went in the money and started showing a loss, the long call would appreciate, having a neutral effect on the net liquidity of your account. But in any case, always collecting the extrinsic amount.

Basically, the returns are capped if the stock goes up in price. If it goes down, at least you get to keep the premium from the short call, reducing the loss incurred on the long call.

I made a spreadsheet to model everything out – even in the worst case scenario where the long call loses all of its value, the premium earned over the lifetime of the contract would outweigh the loss. In fact – I reasoned – the basis cost of the underlying could be paid off typically in less than 6 months.

And that’s how I started trading like this. With the long calls I can easily limit the amount of risk I’m exposed to, and it’s a fraction of the cost of buying 100 shares.

And buying calls instead of shares means that I will never lose more than the value of the long call. Even when the market goes down, I can continue to sell calls to limit the loss. When times are good and the market is bullish, my long position goes up in value and I collect the extrinsic value in the short call. Yes, I’m capped to the upside. But I am more interested in capturing the extrinsic value than watching the position increase in value over time.

Now I’m trading this way, tracking my trades and following others who are doing the same. I hope you’ll follow my blog and read as I navigate this style of trading.