Short Call in the Money: What’s Next?

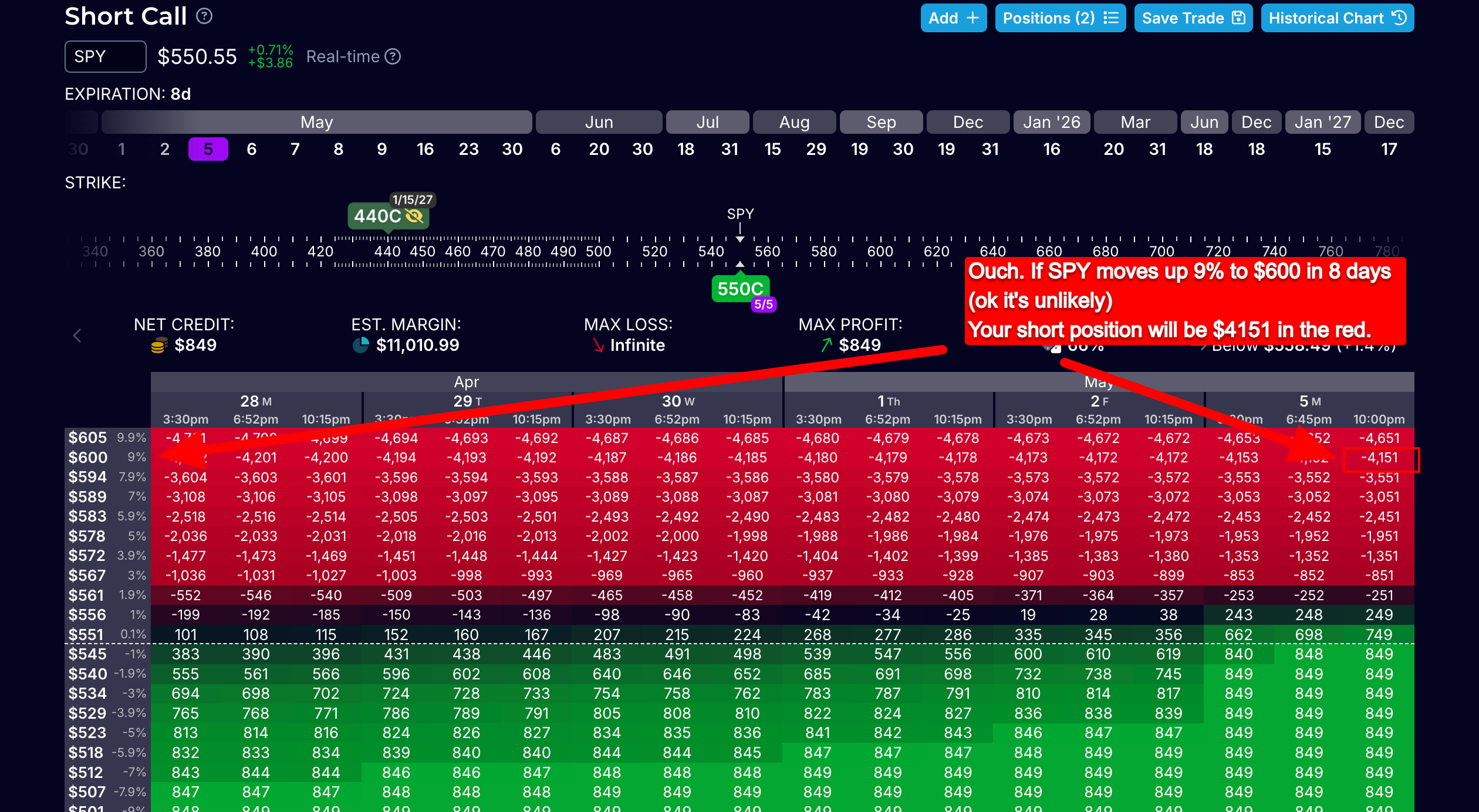

Selling covered calls is great until it “doesn’t work”. I’m talking about when your short call goes in the money and is seriously in the red. A quick move up above your strike price can leave your short call looking pretty ugly.

Curious how you can balance risk, capture extra income, and stay (mostly) calm when prices jump about like an overexcited puppy? — let’s dive in and figure out what happens when your covered call goes in the money and you’re using this strategy.

Crunching the Numbers

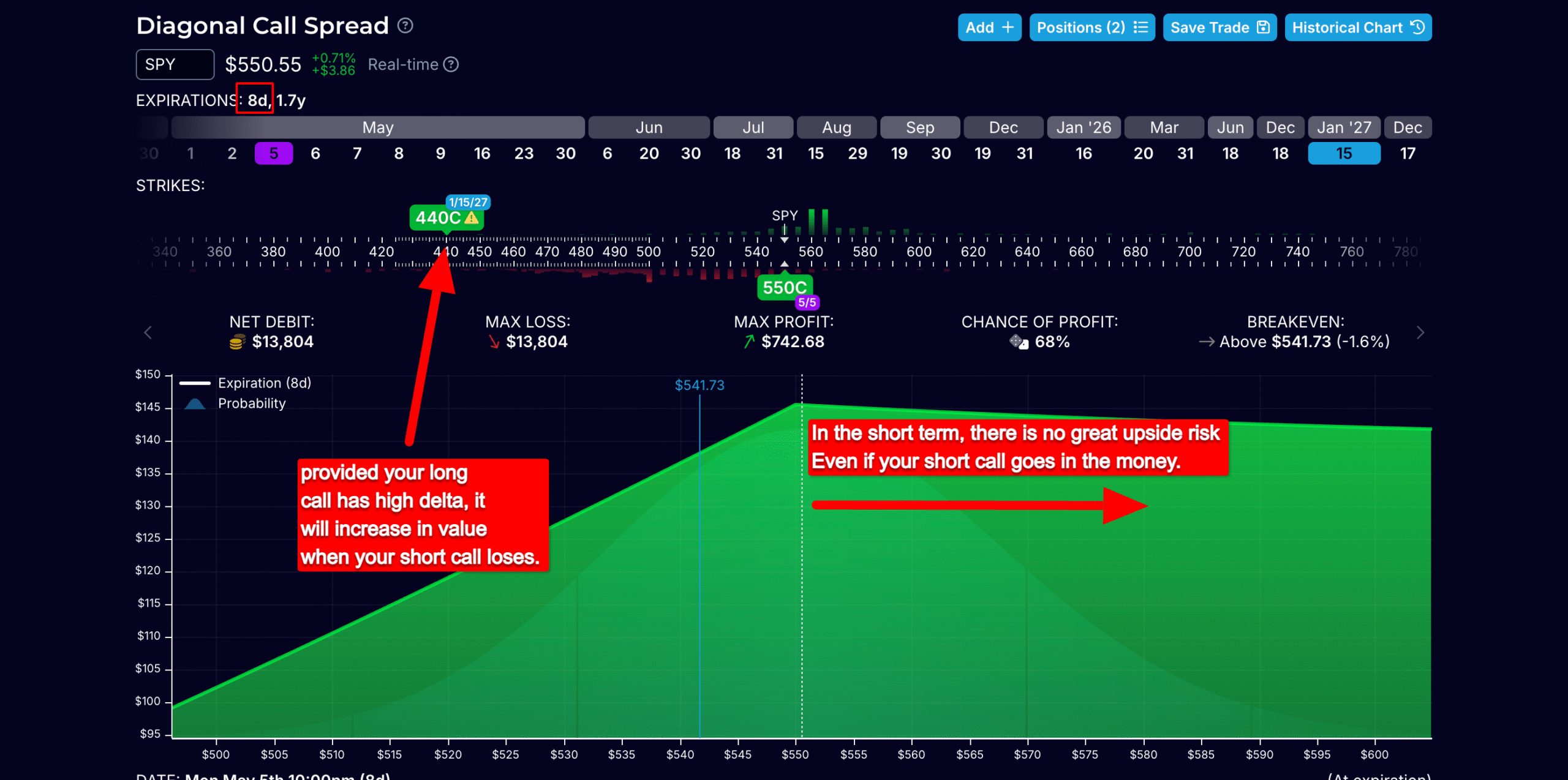

Let’s take a closer look at the intricacies of selling a covered call against a longer-dated LEAPS call.

Imagine you’ve sold a call option, and then the stock price starts rising above your strike price. Suddenly, your short call is in the red. Panic might set in, but this is all part of the calculated risk. It’s a bit like betting on a horse at the races – sometimes they win, sometimes they don’t. In fact…

If you sell a 50 delta call, you should know that there’s a 50% chance the stock price could indeed breach your strike price. It’s a fifty-fifty gamble, much like flipping a coin.

So how can we make money when it’s no better than a coin toss?

The true beauty of this system lies in its protective nature. Selling a call means that you will always collect the extrinsic value of the option. And then if the stock price moves up and your short position goes in the money, your long position will cancel it out.

The answer is to make sure you hold a long call that has a high delta. This acts as a counterweight to your short – moving up as much as the short moves down, cancelling it out. Let me explain…

A Simple Example

Imagine you have taken a long call with a delta of 90. In this scenario, every time the stock nudges up by $1, your call will appreciate by 90% of the amount, or $0.90. It’s a bit like having a mirror image moving in tandem with your reflex actions. Every move in the market translates directly into a move in your investment. Again, Delta 90 moves 90% of the price move.

That means when your short call loses value, your long call appreciates.

If your short call goes in the money, don’t be too worried – your long position appreciates in value, effectively balancing it out.

Now, comes the interesting bit – you also collect extrinsic value. Th play here is to regognise that while your positions might cancel each other out, there is still the extrinsic value you received when selling your call.

It’s like drinking a coffee for the caffeine but staying for the sugar. Both elements play a part, but it’s the extra sweetness of extrinsic value that makes it worthwhile.

Being Neutral to Bullish – the Risk is to the Downside

This strategy works wonders if the stock price hovers at its current value or even takes a mild hike upwards. While the gain might be capped, it’s guaranteed. It’s reminiscent of choosing a smaller but sure dessert rather than gambling on an unknown dish. It’s safer, but does not have as much potential to dazzle.

You can see here, when price goes up, you will still make profits — the extrinsic amount helps buffer that upward move, and the long call appreciates almost as much as the short depreciates. What you’re left with is the extrinsic amount.

Ok, so what happens when the stock moves down?

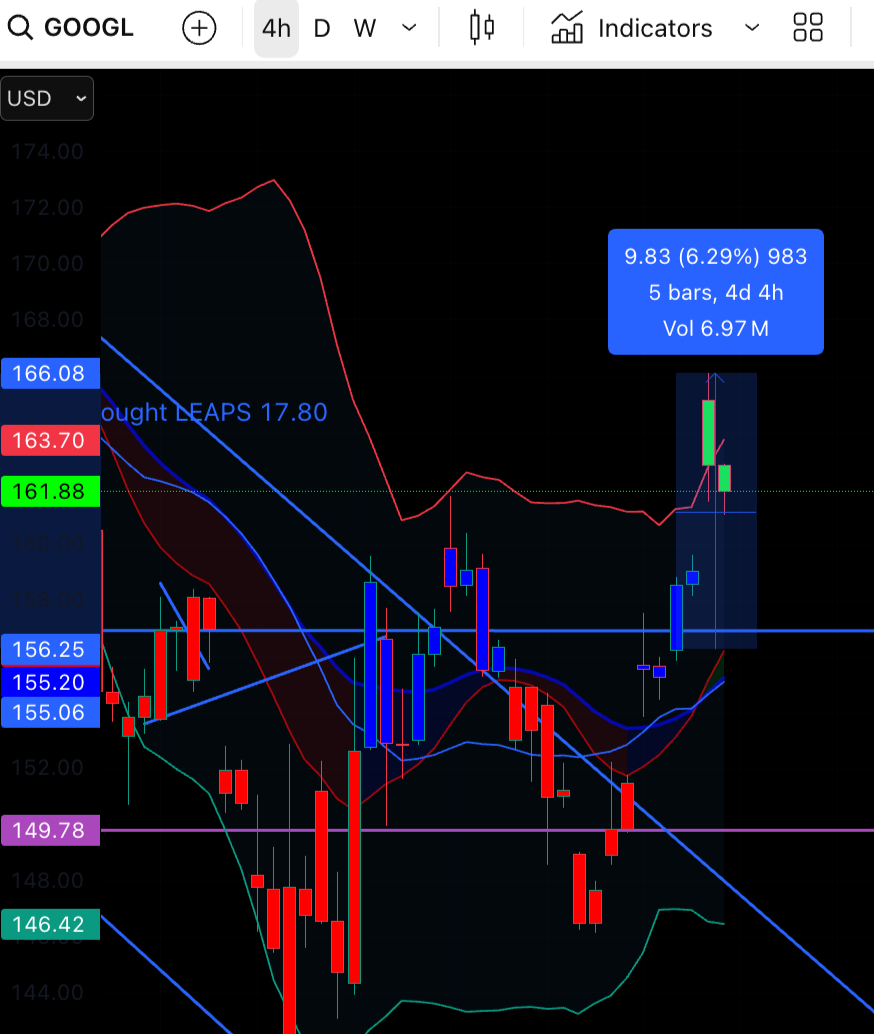

Your long option would depreciate, which is the real risk involved here.

The key thing to remember is that by continuously selling calls, over time, these extrinsic amounts collected can effectively offset what you initially paid for the long call. It’s like having a persistent saving box where you deposit little by little. Yes, you might face minor losses in the short term, but history favours those who think in the long run – eventually your basis will be reduced to $0.

Conclusion : Balance is Everything

A crucial element of this approach is contentment with extracting extrinsic value and not fretting about missed upward spikes. It’s OK to watch your short call go bad, so long as you have a high enough delta on your long call to balance it out.

Remember – your goal is to extract the extrinsic amount. Which is guaranteed no matter the direction of the stock.

Agaaain : If you experience a large upmove and your short call goes in the money, you have to remember that your long will cancel it out. But you won’t really gain as much from the upmove as if you held the long call uncovered – you are capped.

Furthermore, to guard against downside risks, there’s an option to sell in-the-money calls against your long position — if you want to add more downside protection, here’s how you can do it.

And remember, what goes down can be seen as a win when you retain the value of your short call. Eventually, reducing the cost basis of that long call, ideally trimming it down to nearly nothing. This might seem counterintuitive at first, yet like a jazz composition, with time, persistence, and creativity, it harmonizes beautifully.