Master the Mindset: Why Trading for Extrinsic Value in Options is Key to Success Over Growth

Picture this : What if, instead of picking the “correct” stock that over time goes up in value, you just pick a stock and collect weekly income from it – not worrying about whether it goes up or down in value. Sounds rather nice, doesn’t it? There’s actually a way to trade options that doesn’t require second-guessing every market wobble — and might even help you sleep a bit better at night? Let’s dig into the subtleties of selling covered calls, and why a shift in mindset could transform your investing approach.

Consider this idea…

I read something recently that said the richest people made their money on a few well-chosen stocks. It’s a nice idea that you’ll stumble upon the next Palantir or whatever. The reality is that you won’t — otherwise we would all be rich pickign the right stock.

Most traders are on a perpetual hunt for the holy grail of stock investments—the one that will shoot up in value and make them the envy of their investment group. It’s almost intoxicating, isn’t it? This endless chase for that next big win. Quite naturally, many of us find ourselves selling out-of-the-money calls, hoping to make a tidy sum if and when that stock price climbs in a relentless upward march.

The appeal of this strategy is rooted in the potential upside, the chance to pocket gains without missing out while the stock approaches the stratosphere.

But the likliehood is that it won’t. The most likely thing is that the stock appreciates over a long period of time in tune with the market at large.

My strategy involves having a different frame of mind, one that might leave you less harried by market swings. This article aims to walk you through the option of removin the coin toss aspect of trading, offering a fresh lens through which to view your investing strategy.

Trading for extrinsic

Every tick of the market is shrouded in mystery; it’s like an old-fashioned game of hide and seek. Each week, day, or even hour, the market tantalizes us with the unknown—will it dance upwards, or shuffle awkwardly down? Nobody, not even Warren Buffett, can predict with absolute certainty which way the wind will blow, because there’s always that chance of a news event upending the applecart.

Tesla, Nvidia, Google – in the last few months they’ve all had small news items blow out of control and had catastrophic results on the share price.

And so, instead of trying to divine which way the wind will blow, why not consider selling at-the-money calls and pocketing the income? There’s a pragmatic beauty in this approach. Let me explain:

If the price decides to take a nosedive, surprise! You get to clink your glass—it’s all covered call premium, which you get to keep. You sell a covered call with the highest possible amount of extrinsic value — at the money.

Now, in the event that prices rise, there’s serenity too. Your long option floats upward in value, reflecting the market’s jubilant mood back at you. Whether down or up, the extrinsic value is yours to keep, safely nestled like a squirrel’s well-earned acorn.

Again – downward moves are protected by the premium you collected.

Upward moves result in the underlying LEAPS option increase in value.

The result either way is that over time your total VALUE – net liq – will increase.

Let’s look at some examples

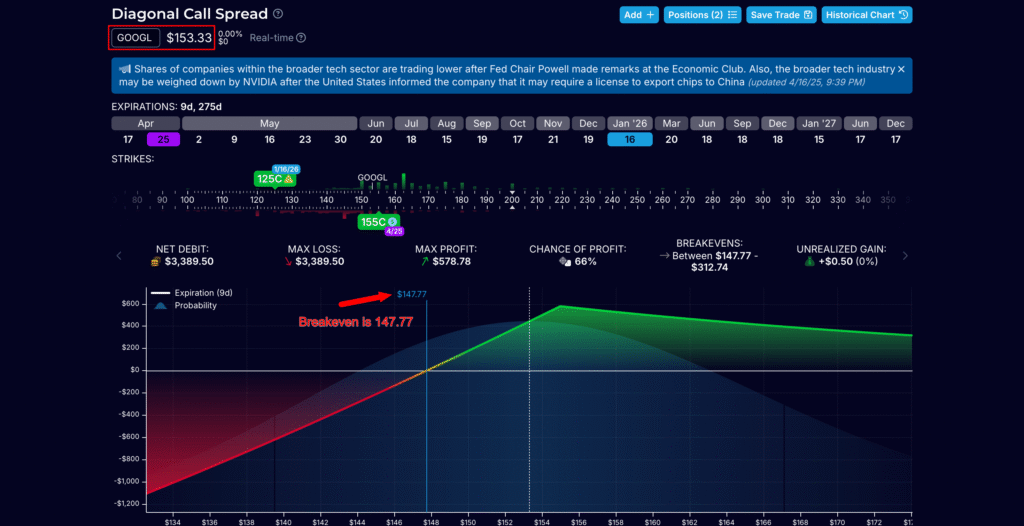

Consider the story of a Google long call, set to expire in nine months. A span long enough to expect the odd panic-stricken mood swing or two. In this time, Google shares have given investors whiplash, with frenetic highs and lows, overturning our bullish convictions.

Each week brings the opportunity to pocket that extrinsic at-the-money value, while being zen-like about the fact that our short position may tip into the money. With a 50/50 shot at either direction, flipping the mental coin liberates us from the perpetual guesswork, letting us focus solely on the strength of our overall position.

This works because the short position has more extrinsic value per day than the long. If we repeat this weekly, overall our net liq will increase, even IF the share price declines.

The net liquidation value becomes the crown jewel here, the thing that we need to think about. Focusing on this essential metric, rather than fretting about whether our short call goes in the money and starts to “lose”. When that happens, our underlying LEAPS will increase in value to cover the loss. And every time we always get to keep the extrinsic value.

Conclusion

Ultimately, in the exciting yet unpredictable world of markets, the future remains forever cloudy. It’s rather like predicting the British weather—fickle, at best (though usually grey and miserable!)

But trading for extrinsic value offers a strategy where winning feels as natural as afternoon tea, regardless of which way the market teeters.

Stock goes up – we win, despite the short call “losing”

Stock does down – we win by collecting short call premium, our LEAPS value does go down

Stock stays where it is – we collect short premium, our LEAPS value only declines slightly

Granted, this method does cap our upside. But consider it this way: we steadily chip away at the long option’s expense over several months, all thanks to the extrinsic “juice” we collect every week.

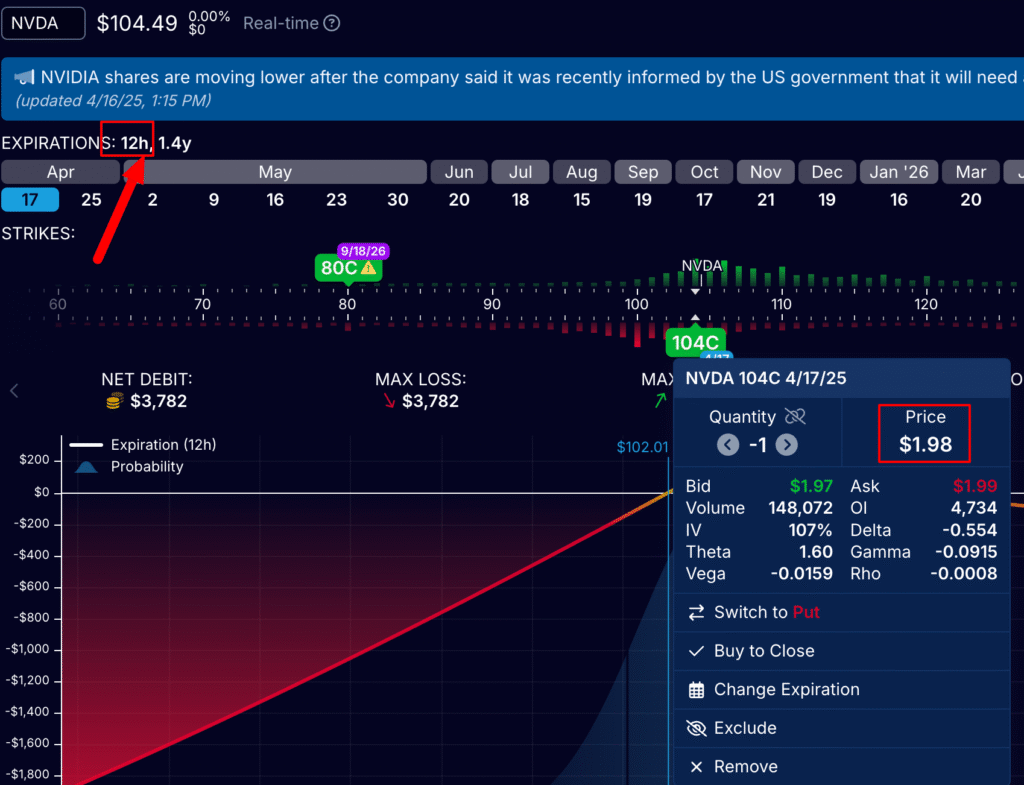

Google is a bad example because it’s heading into earnings, but consider this NVDA at-the-money call. With only 12 hours left, there is still $198 of premium available.

You can start to see why selling short calls eventually generates enough to pay for the underlying LEAPS position.

You see, shifting your mindset to embrace this strategy could liberate you from the exhausting task of playing Mystic Meg with market directions. It’s a different rhythm, a slow dance compared to the breathless sprint of other strategies. Free yourself from the 50/50 coin flip and just trade for extrinsic value.