How Beta Values Impact Your Success with Covered Calls

Selling covered calls can sometimes feel like finding loose change down the back of the sofa—small wins that add up nicely over time. But not all covered calls are created equal, and the choice between a volatile growth stock and a slow-and-steady ETF can dramatically change your returns (and possibly your heart rate).

So, how do you decide which route to take: do you chase the thrill of higher premiums or lean into the calm of steady drips of income? Read on to explore the trade-offs, the hidden gems, and how to strike just the right balance for your portfolio.

Some Stocks Move More Than Others

Maybe you’ve already noticed that the more a stock moves, the higher the premium you receive when selling a covered call on it. This is where things get interesting: not all stocks are created equal when it comes to volatility.

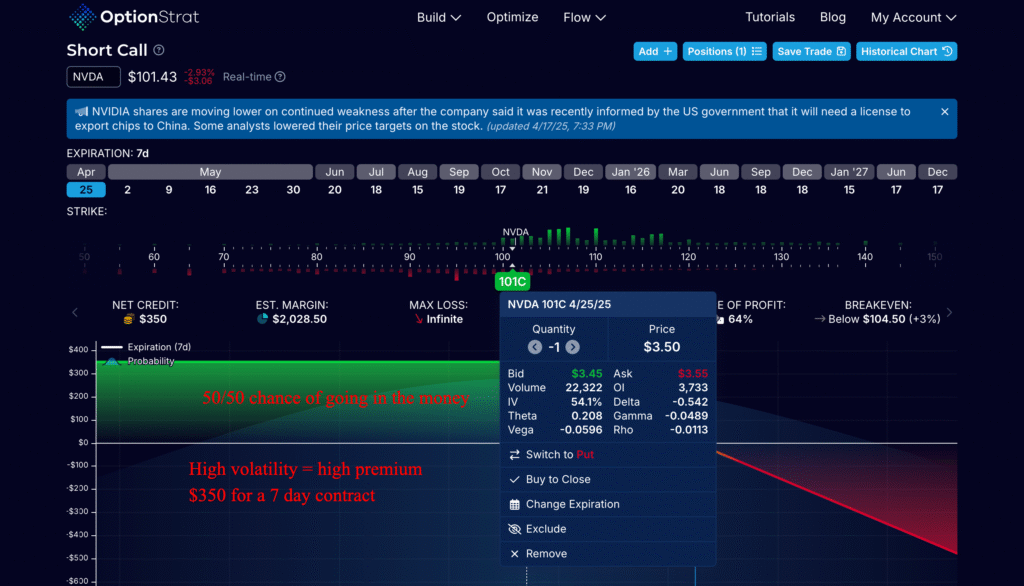

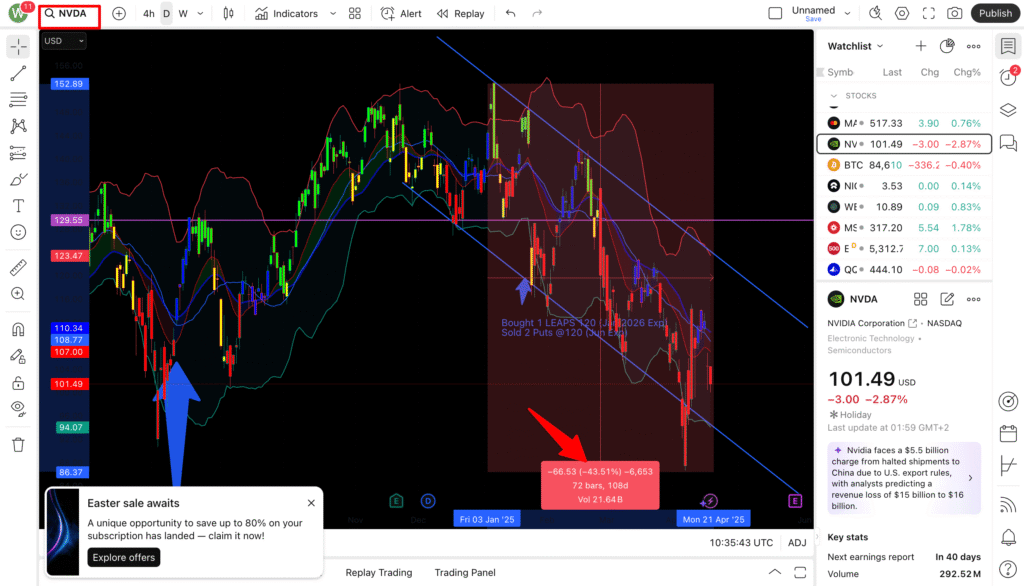

Stocks that bounce up and down a lot tend to have higher premiums compared to those that trundle along. Exhilarating for the trader but also a tad nerve-wracking. Selling at the money covered calls means our chance of going in the money is already 50%, but when it does – with a volatile stock – it could be deep in the money pretty fast.

However, that additional risk is passed on in the form of higher option premiums, positioning it as an exciting opportunity for those willing to ride the wave.

It makes sense, doesn’t it? More stock movement equals more risk, and risk commands a premium. At the end of the day, selling covered calls means selling insurance. Higher volatility stocks promise the allure of more significant profits but also come with the potential for significant downsides.

Consequently, options for these stocks are priced with bigger premiums, reflecting the balance between risk and reward. Higher premiums might seem like the golden ticket, but remember, they come with their own set of challenges, as both profits and pitfalls are amplified.

But is it better to have an underlying that’s more static or one that moves a lot more? That’s the million-dollar question. Stocks with less movement provide steadiness, much like a trusty British brolly in a drizzle, offering predictability and less stress.

On the flip side, dynamic stocks, although riskier, can provide attractive premiums, potentially rewarding the daring and adventurous. Ultimately, finding the balance that aligns with your risk tolerance and investment goals is key.

Our Old Friend ETFs

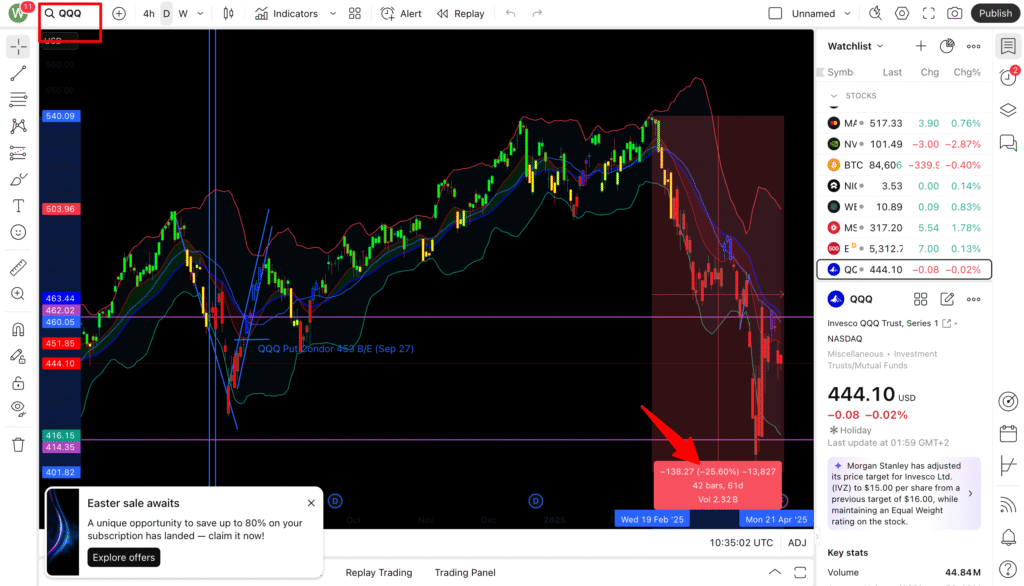

Let’s talk about ETFs, which are like the sensible friend who always brings common sense to the party. They have a lower beta weighting, which essentially means they’re not prone to dramatic swings. Picture them as the calm, unflappable sort who keeps a stiff upper lip amidst chaos. This stability is due to their diverse nature, usually encompassing a broad range of assets that shield them from extreme market movements.

The consequence of a lower beta? ETFs typically move less and offer less chance for huge gains in a short time frame, but they also protect you heavy selloffs.

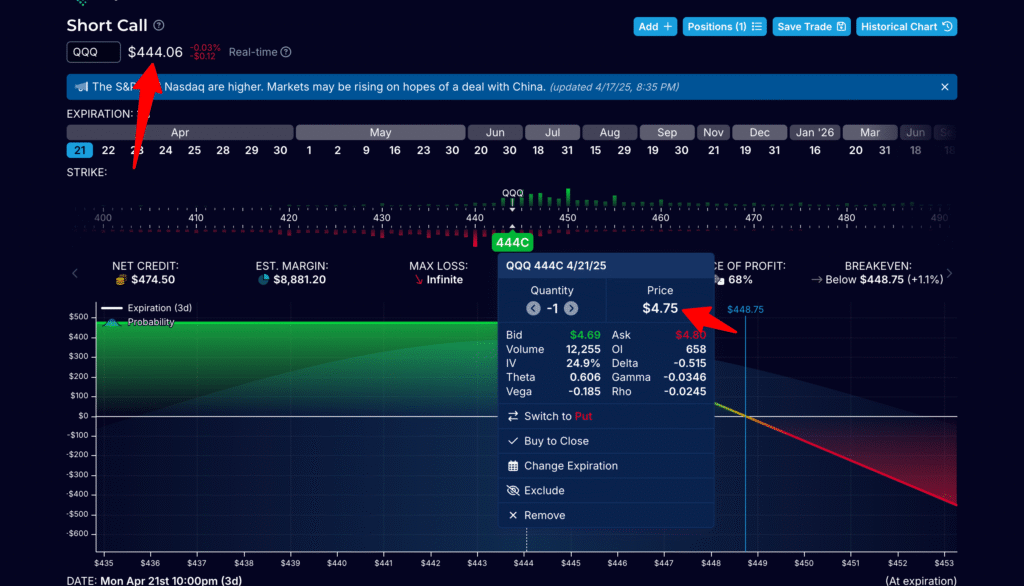

Compare NVDA with the QQQ ETF. To buy 100 shares of QQQ I’d need to sped $44,400 vs $10,100 for NVDA — but the covered call premium I receive is only 35% more. So for committing more cash, I only get a marginally better premium and far lower return on capital.

On the other hand, with less price movement, the extrinsic value of covered calls tends to be lower. That also means your LEAPS or 100 shares are not likely to plummet overnight, which can be a soothing thought.

Compare NVDA to the ETF – the EFT will always move less than the individual stock, because it’s an averaged basket of stocks. The result is that you get a higher return on capital choosing growth stocks, but there is more risk that you will suffer greater losses on your underlying shares or LEAPS position, than the ETF equivalent.

The Best Option for LEAPS

Let’s think for a second about our LEAPS—those long-term options. ETF LEAPS do come with a heftier price tag, not unlike a posh school uniform, yet the underlying assets often don’t experience the same level of price swings you’d see with individual stocks. ç

And considering we’re going to hold our LEAPS for 1+ years, this can be appealing. They’re more expensive upfront because you’re committing for the long haul, which offers clearer visibility on returns. And aren’t we always being told that SPY in the long run always goes up?

In my experience, the ETF’s offer a solid, stable foundation. The odds of ETFs taking a nosedive are slimmer, making them less risky over an extended period. In recent times, some tech behemoths like META or AAPL have become a bit like honorary ETFs—vast enough to wield stability yet capable of rewarding patient investors.

If this is your first foray into selling covered calls against a LEAPS position, better to choose a more expensive ETF LEAPS and enjoy the less crazy moves, and be comforted knowign that in the long run – i.e. the length of the contract- the value will increase.

And yes, I know it’s tempting to sell an OTM call a few strikes out every week, but there are plenty of reasons to sell ITM or ATM covered calls.

Conclusion

In conclusion, a savvy investor probably wants a mix of ETFs with “riskier” stocks in their portfolio. It’s like eating a balanced diet— it’s fine to have the occasional doughnut but you wouldn’t want to live off them. A mix of EFT and growth stocks (bought as LEAPS) can provide the best of both worlds: the stability of ETFs and the excitement and higher premiums from stocks with a bit more “oomph.”

Always keep an eye on volume and liquidity to reduce spread. Trading in liquid markets ensures that the execution of trades is smooth and the costs remain minimal. You don’t want to be stuck in a mire, trying to trade an illiquid option while the market races ahead.

So go for big names; there’s more volume.

A LEAPS SPY option is almost comparable to holding the S&P 500 long-term, especially if it’s very deep in the money. So if you’re someone whose trading strategy is aligned with broader market trends, this may already reflect your original thesis.