Getting Revenge on Grindr – Selling covered calls for $140/month

Ever looked at an app so glitchy, it feels like it’s trolling you every time you open it—yet somehow, its stock price just keeps climbing? I did, and instead of throwing my phone across the room, I decided to log out and use a strategy that earns income from covered calls on GRND. Curious how a terribly “social media” app could lead to a tidy monthly income?

Worst App in the World? Now Grindr Pays Me!

We need to talk about the notorious Grindr app. If you’ve ever had the misfortune of using it, then you’re familiar with its delightful unpredictability. Imagine writing the perfect message, only for the app to crash spectacularly before hitting ‘send.’ This isn’t a rare occurrence; it happens almost as frequently as sunshine in London.

Some say it’s all part of a cunning strategy to entice users into subscribing for a more ‘stable’ experience, or perhaps it’s the classic winner-takes-all business approach that keeps Grindr’s engine chugging. Whatever the case, it seems to be working wonders for the business, and ultimately the GRND stock price.

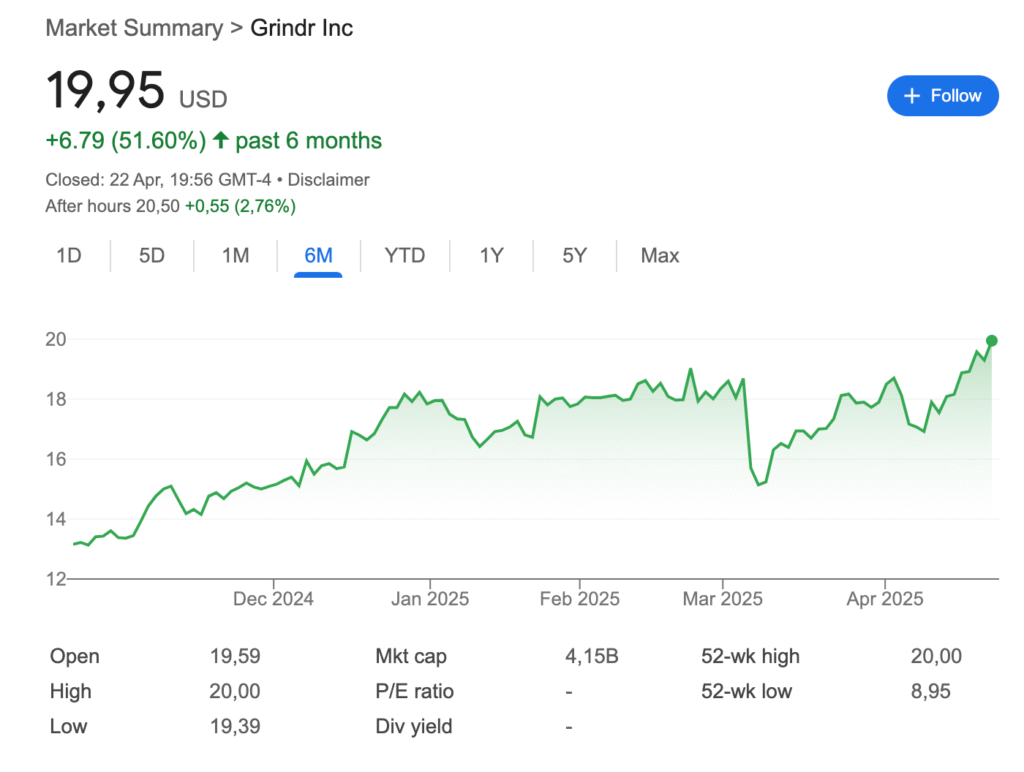

Grindr’s stock continues to perform an impressive hike, climbing and climbing with every passing week. It could be down to algo traders giving it a helping hand, or it could be sheer determination on the stock’s part.

Yet here I am, stubbornly refusing to pay for an app that crashes more often than a toddler on a stepsession. But what if there was a way for Grindr to pay us instead? Enter the covered-call strategy. It’s a brilliant way to earn money and outsmart the system. Could we potentially flip the tables and have Grindr rewarding us for a change?

The Winner-Takes-All Company

This idea of using Grindr for a profit isn’t something plucked from thin air. In fact, it all began with a little inspiration from Matt’s “Market Moves” channel. There, I was captivated by an intriguing segment showcasing how Grindr’s stock price was defying the odds and rising steadily, as if it had charmed the market gods themselves. With each passing trading day, the price keeps ascending to new heights, and one can’t help but wonder if algorithmic traders are nudging it further up the mountain.

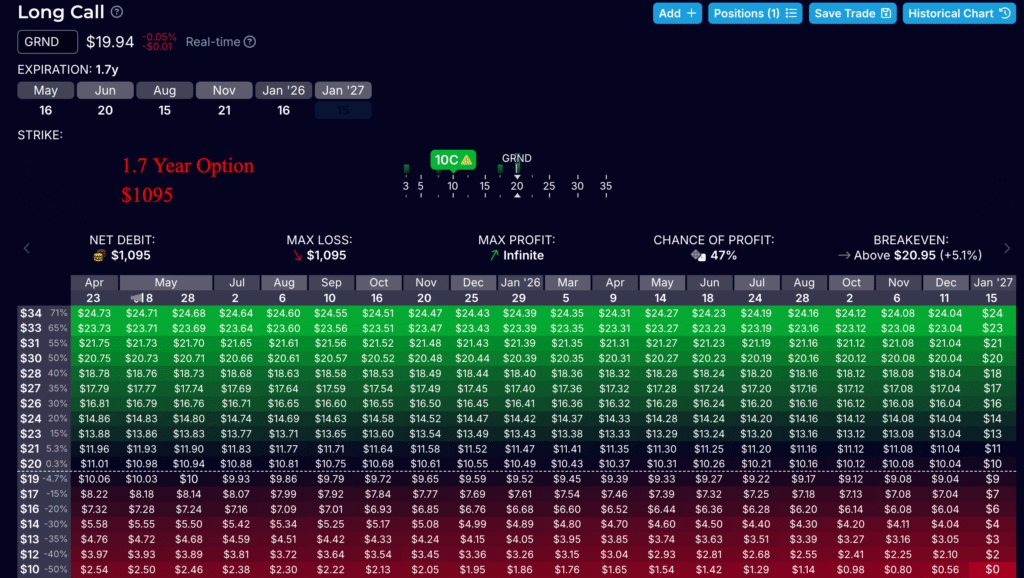

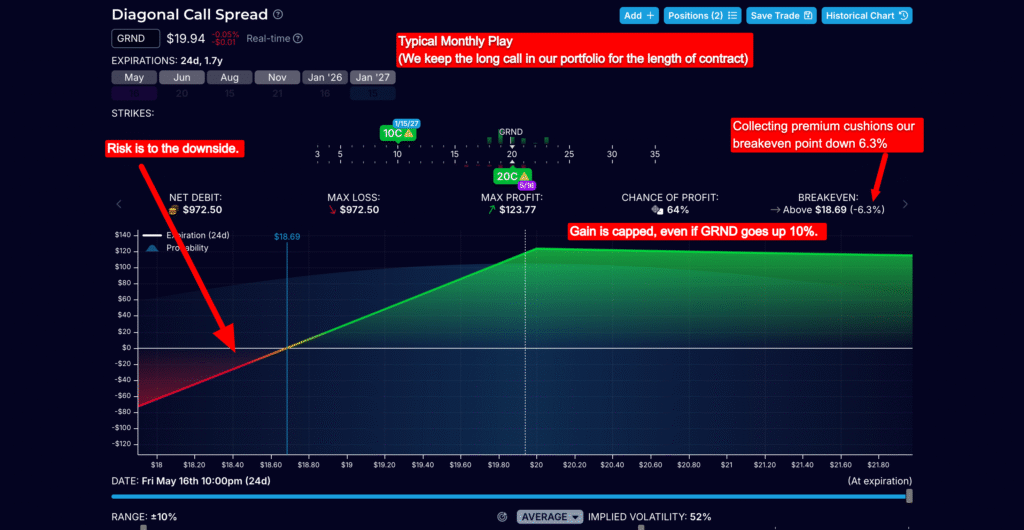

So, what’s a savvy investor to do? We could simply stand on the sidelines, invest in a LEAPS (Long-Term Equity Anticipation Security), and patiently await more appreciation. However, there’s also the enticing possibility of capturing income from the extrinsic value of selling ‘at the money’ calls. It’s a calculated risk, like betting on a particularly tricky horse race, but the rewards could be worth the nail-biting suspense.

Collecting $140 a Month on Grindr

Here’s how the strategy works : you start by buying one long call with an 80-90 delta. This isn’t as complicated as it might sound and requires an initial investment of about $1,000, which allows you to hold this option firmly until January 2027. Then, you sell a monthly at-the-money call and collect the premium.

What happens when Grindr’s stock price fluctates?

If Grindr’s stock goes up, the underlying long call naturally increases in value. Although we might experience a loss on the short call if it goes in the money, the premium we’ve collected cushions this effect. On average, we could approximate $140 in extrinsic value from selling that short call, per month. Now, if Grindr’s stock slips or treads water, we still keep the $140, although we need to accept a loss on the underlying call.

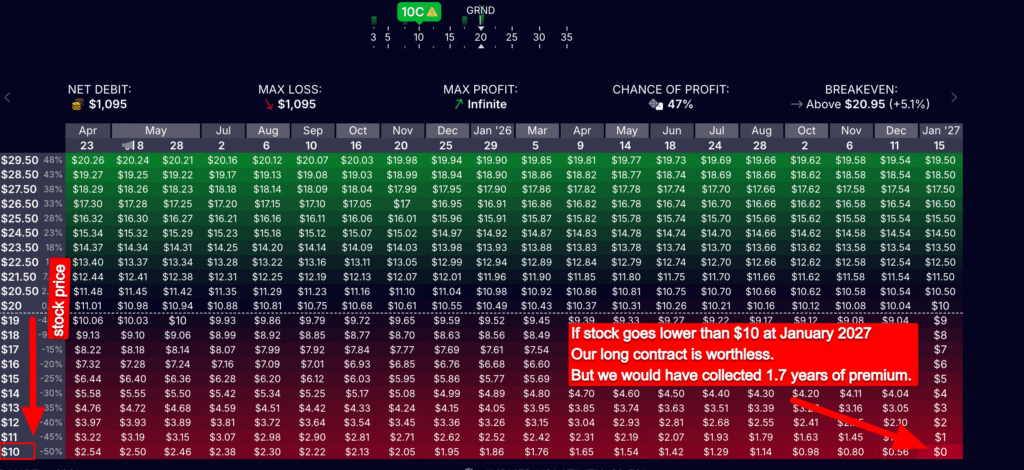

The most we ever risk is the value of the long call. However, even if the stock pulls a fast one act and the long call’s value goes to zero, we’ve likely collected close to $1,000 over roughly seven months.

Let me say it again – the basis of the long call should be reduced to $0 after approximately 7 months of selling premium this way. That means if GRND continues to climb, we net $140 a month. If it goes down, the $140 contributes towards paying off the long option. After 7 months any premium we collect is pure profit.

Don’t try this at home

Now, let’s take a step back for a moment and think about why Grindr DOES NOT FIT the profile of the classic covered call stock :

- Liquidity is bad (not many people buying and selling calls)

- Spreads are wide – we don’t always get a good price for our options, see above.

- Weekly options aren’t availble. Only monthly ones.

It doesn’t boast good liquidity, nor is it equipped with the luxury of weekly options. Yet, it’s a bit of fun to show you an example of how this strategy works. And for anyone who’s used Grindr and struggled to cope with its dreadful glitchiness, I thought this would be a fun thought experiment.

Using this strategy means that after seven months of collecting monthly premiums, the initial investment can be covered even if the underlying option hits rock bottom. Of course, if everything takes a downturn, the maximum loss is limited to the value of the long call. To those enticed by the thrill of ‘beating the system,’ this might just be the opportunity to jump in, feet and all, and see the Grindr adventure leads…

Post your Grindr horror stories in the comments.