Can You Make 2% A Month Even in a Declining Market?

Introduction

When the market zigzags like a toddler on a sugar high, how do you stay grounded—and more importantly, profitable? If you’ve ever wondered whether there’s a way to make money from a falling share price (other than an emergency chocolate-fuelled sulk), you’re not alone. In this post, we’ll unpack a clever approach to selling covered calls—even on volatile stocks like Microstrategy—and how one investor managed to squeeze a tidy gain from a 40% drop. Curious? Let’s dive in.

Big Risk = Big Declines

In the world of investing, Bitcoin-focused Michael Saylor’s company “Strategy” or perhaps more recognizably “Microstrategy” has emerged as a byword for risky investing. Its reputation precedes it, known for volatile swings and the contrarian investors it attracts.

At the end of 2024 and beginning of 2025, the share price of Microstrategy saw a meteoric rise, only to tumble back down by a staggering 40% over the past few months. Such is the tumultuous nature of stocks like these, making them both a thrilling and daunting proposition for those looking to make a quick buck. One moment you’re up, and the next you’re scrambling to recover.

Yet, some have found ways to navigate this landscape with a degree of finesse. Take, for instance, a fellow Youtuber and covered-call enthusiast, Mark. In his video, he illustrates how, despite the sharp decline, he managed to secure an 8% gain on his position over just four months. His strategy involves a clever blend of innovation and caution, showing that even in the face of adversity, success can be captured.

Video Summary

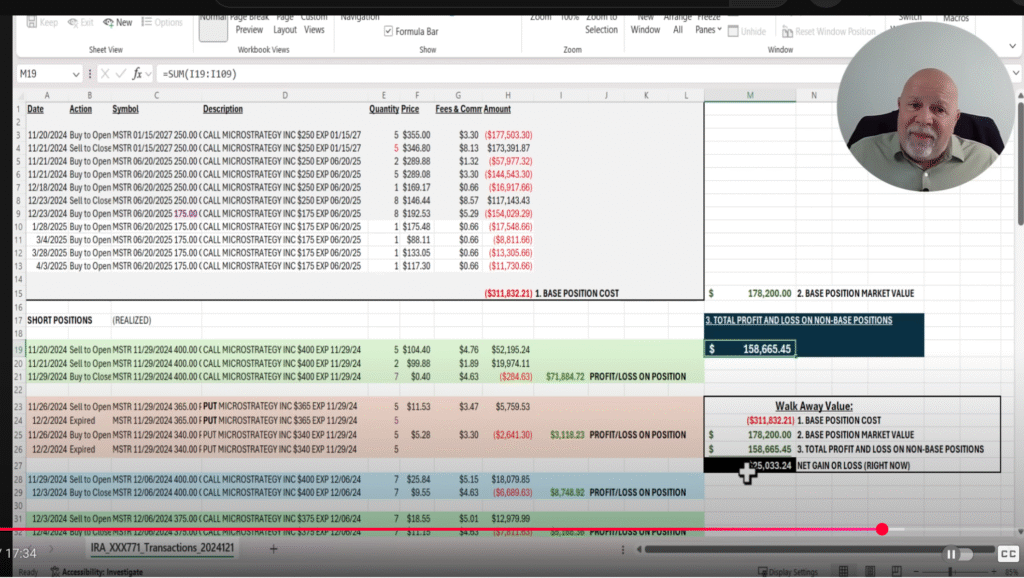

Mark’s journey began with a bold move: investing $310,000 on LEAPS during an upswing in the stock’s value. This might sound intrepid, and it certainly is, but therein lies the essence of his strategy. By leveraging LEAPS and selling calls against them, he positioned himself to reap rewards that would outshine short-term fluctuations.

What’s admirable is Mark’s diligence in computing cumulative gains against the backdrop of covered call wins and losses. It’s a delicate balancing act, but when executed proficiently, it reveals the potential for substantial net results. His calculations depict a clear picture, leaving him with a net gain of $25,000 at the end of his investment period.

Another intriguing facet of Mark’s approach is his choice to roll in the money LEAPS to maintain a delta close to 90. Yes, this uses cash but also means the underlying is going to increase in value at almost $1 per $1 move upwards. These strategic adjustments can make all the difference. Let’s dig into the maths…

Think about it – if MSTR went up $5 one week, and put your short call in the money by $5 (in reality less because you have the extrinsic value as a cushion), your long position should increase the same amount to cover this “loss” on the ITM short call.

If the delta is too low, the long position won’t increase enough to cover the in-the-money amount.

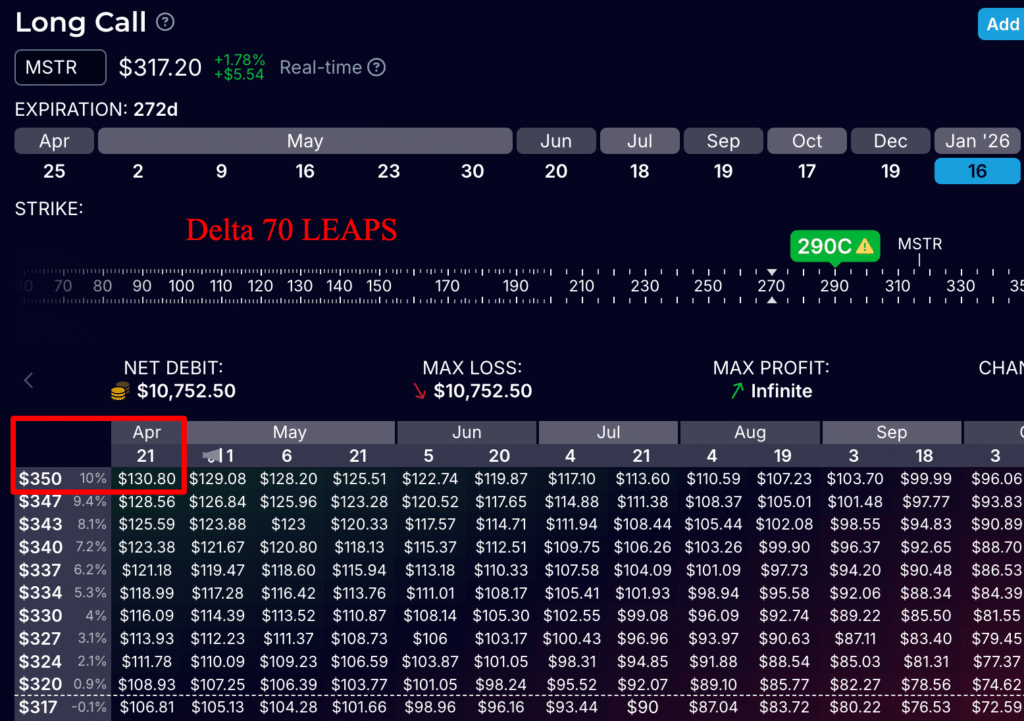

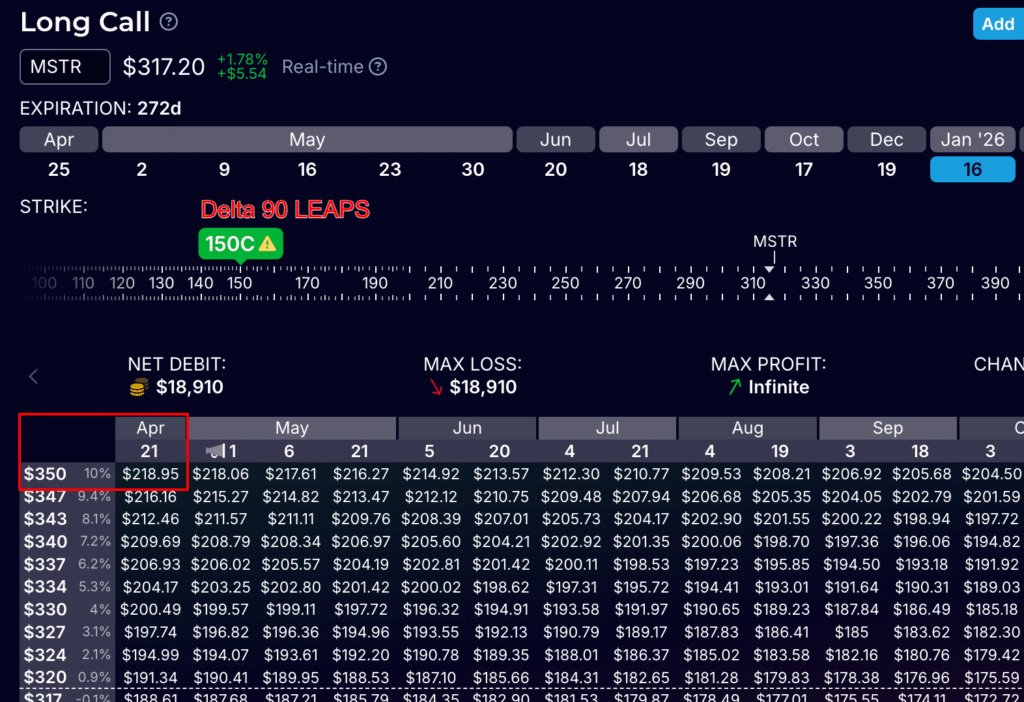

Let’s compare a Delta 70 and Delta 90 LEAPS :

The difference (other than the cost to buy the LEAPS in the first place) is how the value of the LEAPS behaves when the stock price goes up or down.

Take our 70 Delta LEAPS — if the underlying stock goes up 10% to $350 by April 21st, the LEAPS will be worth $130 (we are paying $107 for it) = $23 increase.

Compare this to the Delta 90 LEAPS. For a 10% move we will see a larger increase in relative value – a $29 increase. Why is that important? ….

This is important because it’s the cushion we need when our short calls go in the money. With a higher delta, we have more protection. With a low delta LEAPS there’s a chance that the long position won’t increase in value enough to offset any in-the-money amount of the short calls.

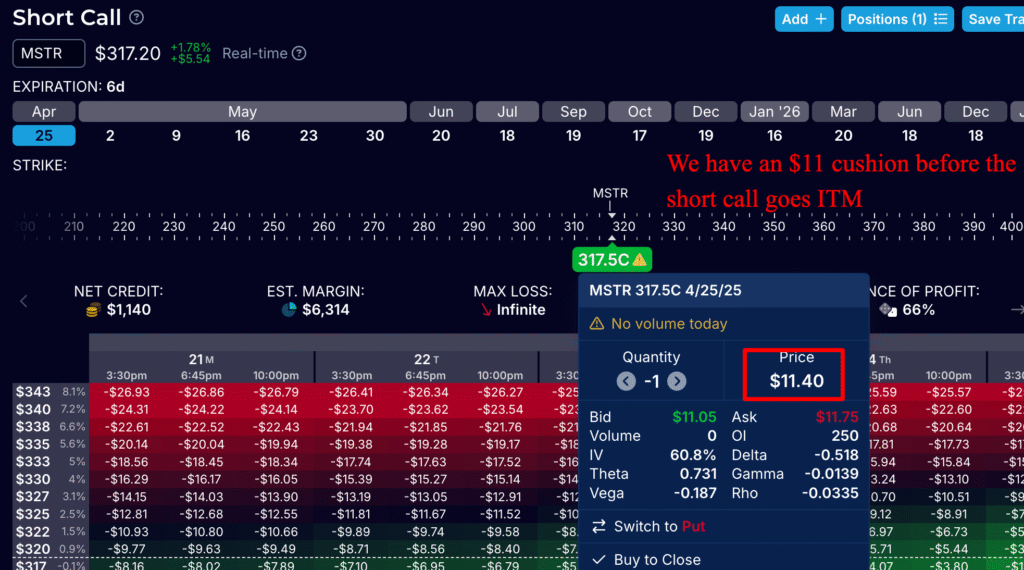

When we sell the call at the money, it’ll pay us $11.40 – so MSTR can move up $11 (to $328) in the next 6 days and we would still break even on the short call. Above that, the short call is going to be a loss.

In the event of a large move, like a 10% move in a week (unlikely but does happen to volatile stocks like MSTR), we would have more protection with the Delta 90 than the Delta 70 LEAPS, as this higher 90 delta LEAPS would increase more in value than the 70 delta one.

Selling Covered Calls – A Way to Protect Losses

Mark’s strategy prompts a compelling consideration. If faced with a direct 40% loss after holding shares, even a hefty $25k wouldn’t cushion the fall adequately. Selling covered calls offers a strategic hedge against such downturns, underscoring its role as a mechanism not merely for profit but for protection.

This is where holding LEAPS stands out as a pragmatic alternative. Rather than binding youself to shares susceptible to volatility, selling calls against LEAPS provides an adaptable vehicle. It allows investors to benefit from upward movements while buffered against precipitous declines.

Conclusion

Even amidst the turbulence of declining markets, with high volatility and equally elevated premiums, the covered call strategy holds potential. It showcases the ability to generate revenue when conditions seem bleak, offering a beacon of possibility in the choppy waters of market downturns.

Achieving a 2% return per month through such a strategy represents an increaseible result, not to be underestimated. Consider this in contrast to holding an SPY ETF, where average returns hover between 7-10% annually. In uncertain years, this could even swing to zero or tip into the negative, reinforcing the appeal of alternative strategies.