Return on Capital : Comparing 100 Shares vs LEAPS

The classic way to sell covered calls involves buying 100 shares and selling an out-of-the-money call. But what if you could achieve similar returns with far less capital, while still enjoying some of the same perks? If the phrase “LEAPS” has ever left you scratching your head or reaching for Google, stick around — we’re about to unpack how this alternative might be the smarter route for your portfolio.

Shares vs LEAPS : What’s the difference?

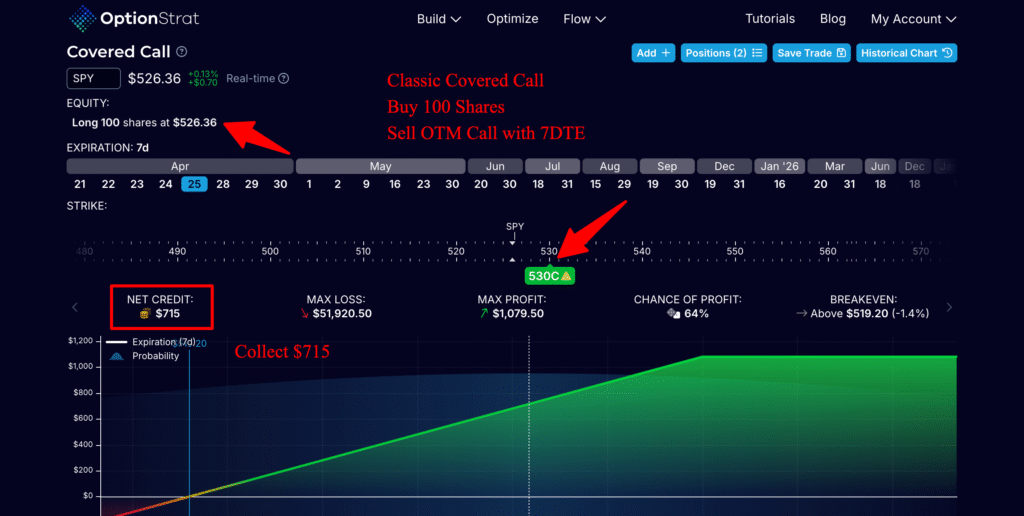

You’ve probably heard of the classic method: buy 100 shares of a stock and selling a call option against them that’s out of the money. The call you sold means that your shares will be called away if the spot price goes above the strike price (see below, above $530)

This straightforward strategy allows you to earn premium income while holding the actual shares in your investment portfolio. If price moves up, you keep the $715 premium and give up your shares at $530 – also benefitting from the appreciation of your shares.

But hold onto your hats, because there’s another player in town known as LEAPS, or Long-term Equity Anticipation Securities.

These are options that have an expiration date much further into the future than standard options. While they might sound like something out of an ambitious corporate presentation, they’re actually a savvy tool for investors looking to leverage covered calls without the heftier initial investment in shares. LEAPS are typically long call options that do not expire for a year or more.

In this blog post, we’re going to dive into both options — shares and LEAPS — and weigh their pros and cons. Most importantly, we can compare the return on capital of both.

Comparing the Cash Investment

When it comes to buying shares outright, one of the standout benefits is that you get to hold them indefinitely. It’s akin to holding onto an old vinyl record; it collects dust perhaps, but you can always dust it off and enjoy its value at your leisure.

This indefinite holding period means you can continue writing covered calls for as long as you have the shares, offering a persistent opportunity for income generation. Although beware, writing calls against stock that has gone down in value since you bought it may require margin.

LEAPS, on the other hand, come with an expiry date, much like the milk at the back of my fridge. However, these expiry dates can be set sufficiently far into the future, making them long enough to benefit from longterm upward drift.

Another consideration is dividends. Shares often come with these extra rewards. Investors can reinvest dividends to grow their wealth over time or simply enjoy the extra income stream.

Unfortunately, LEAPS don’t have this luxury, as they don’t earn dividends. But don’t let that deter you; LEAPS have their unique advantages which can compensate depending on your investment goals. And here’s why:

Delta 1 LEAPS behave the same way as shares do

Purchasing LEAPS that are deep in the money is actually very similar to holding the shares themselves. It’s like renting a luxury car instead of buying; you still get to enjoy the drive without making the hefty purchase.

A LEAPS with a Delta of 1 will move dollar-for-dollar with the underlying stock, allowing your position to behave like the shares themselves.

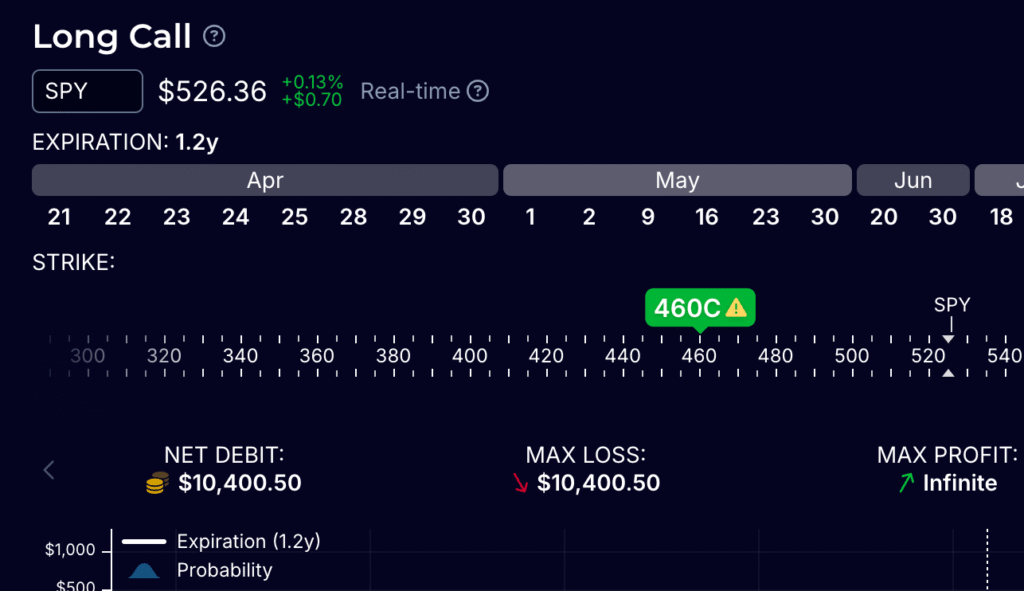

The key difference between shares and LEAPS is the cost. LEAPS typically require only about 1/3 of the cash outlay when compared to buying shares outright. This massive difference in capital requirements opens up options for investors with limited funds but who are still eager to participate in covered call strategies. You can effectively leverage your capital without tying it all up in a large stock purchase.

Calculating Return on Capital

Let’s get to the nitty-gritty with some numbers. If you’re selling weekly ATM options on the SPY, buying the actual shares will set you back a hefty $52,636 at today’s price. While capital appreciation sounds lovely on paper, we aren’t always in it for that with covered calls; we’re here for collecting the weekly extrinsic value of our options. This makes the investment in shares a long-term play with consistent potential returns.

We’re here to collect weekly covered call income and are not directional traders.

LEAPS, on the contrary, do act like a ticking clock with an expiration date. However, if the SPY’s price climbs, the option value might only decline slightly, offering a reasonable comparison to holding shares. Here, you’re essentially only “paying” for the extrinsic value over time, similar to a ticking meter on a taxi ride.

Let me explain it another way.

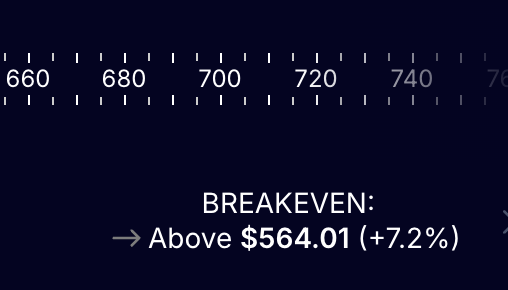

The LEAPS you buy today is worth $10,400. At the end of the contract, if SPY has moved up by at least 7.2% (the breakeven point), your LEAPS will still be worth $10,400. The value of the LEAPS does not go down to 0 at the end of the contract.

So if that obtains, at the end of the contract you can simply turn the LEAPS back into cash, or roll it out another 1.2 years without any loss. This gives you the right to sell calls again for the lifetime of the contract.

Ok I’ve explained that LEAPS can hold their value despite running out of time. So back to the point of this article : let’s compare the capital return on both holding shares and selling covered calls and holding a LEAPS and selling covered calls.

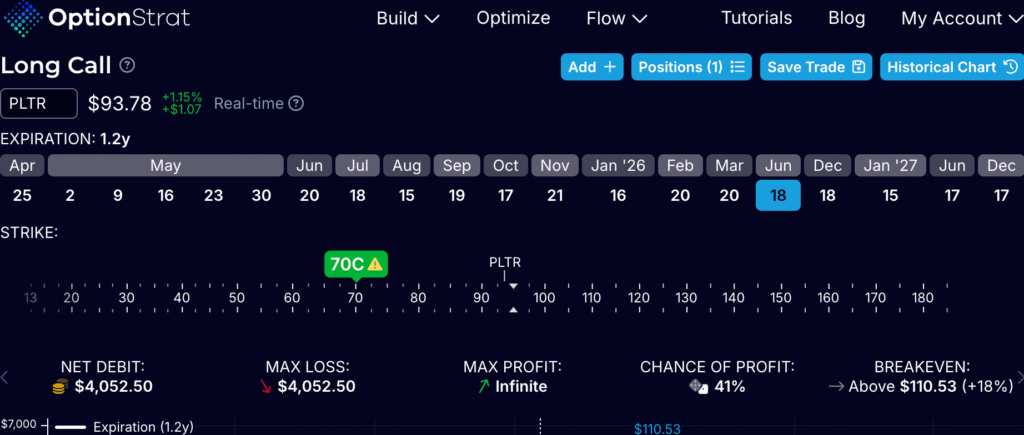

- Shares – Palantir

100 Shares will cost $9378

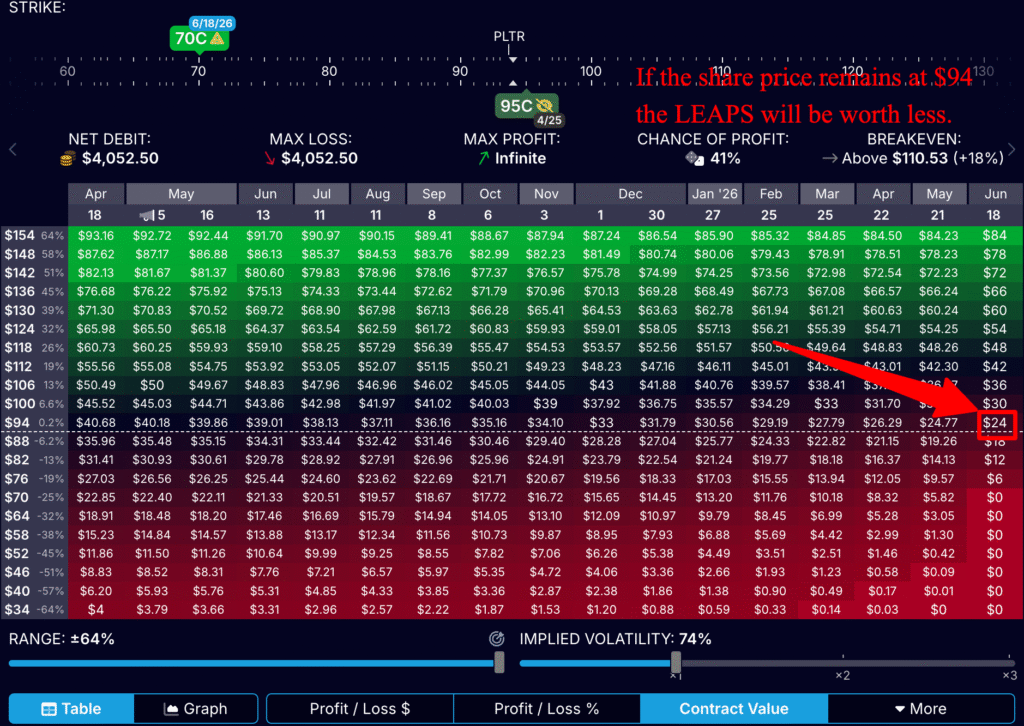

1 LEAPS will cost $4052

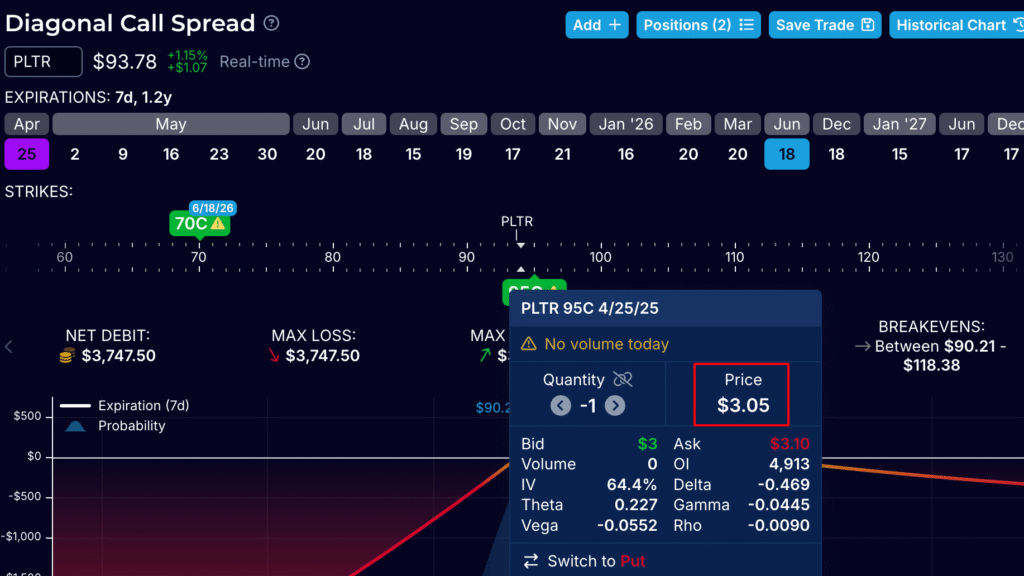

Covered Calls :

7 DTE contract sells for $3.05

At current rates, we would earn $305 per week on an at-the-money call

Let’s say our LEAPS option expires in 1.2 years, 63 weeks.

And let’s assume the price of PLTR does not increase or decrease over that time. In that case our LEAPS will be worth less than what we paid for it, whereas the shares will not.

After 63 weeks, our LEAPS is worth : $2400 (a loss of $1500ish)

our Shares are worth : $9378 (no change)

ATM earnings :

In either case, we earn weekly ATM call income at $305 (in reality it would be less than this, as PLTR has above-average volatility at the moment)

$305 X 63 weeks = $19,215

LEAPS : $19215 – $1500 (loss on underlying) / $4052 = 4.37x profit in 63 weeks

Shares : $19215 / $9378 = 2.04x profit in 63 weeks

Recall that selling at the money calls makes you indifferent to direction : if the calls go in the money (there’s a 50% chance of that happening), your short call will lose but the underlying will gain, cancelling each other out but leaving you with the extrinsic value you sold. Read more about selling ATM calls here.

Let’s say PLTR absolutely tanks, and ends the period at $70 per share.

Sorry to tell you this but your LEAPS is now worth nothing.

Your shares are now worth less than you paid for them.

LEAPS Value : $0 ($4052 loss)

Shares Value : $7000 ($2378 loss)

Looks like we lost less on the shares. And we still have $7k of value left in them, which is good – right? We can cash in that $7000 and walk away with our tail between our legs. Plus all the covered call income we collected over the last 63 weeks.

But let’s analyse the return on capital here, when our LEAPS goes to $0.

LEAPS : $19215 – $4052 (loss on underlying) / $4052 = 3.74x profit in 63 weeks

Shares: $19215 – $2378 (loss on underlying) / $9378 = 1.79x profit in 63 weeks

This simple calculation is a way to show you that even if your long LEAPS goes to $0 and expires worthless, you will still make a higher return on capital by selling covered calls against a LEAPS rather than shares.

The other advantage of the LEAPS approach is that you can never lose more than the total value of your LEAPS. In other words, even if the share price declined to $60, $50, or even $40 – your max loss for the long position woul dbe $4052. With the shares you could lose a lot more.

I hope this has given you some insight into how selling covered calls against a LEAPS position actually provides a higher rate of return than a traditional route selling shares, even though we may all have a bias towards owning the actual shares (whether for dividend income, or simply because they retain more value).

even if your leaps goes to $0, you will still have a better return on capital than buying shares as your underlying asset.

If we are maximising covered call income for returns, ther’s no question that buying LEAPS and selling calls against it is the option with the best return.