When the Market Moves Down : Protecting Positions with In-The-Money Covered Calls

Covered calls—simple in concept, surprisingly nuanced in practice. Most folks reach for them in sunny markets, hoping to bank a bit of premium while their shares skyrocket upwards.

But what happens when the skies turn grey and the market starts to tank —can this strategy still keep your portfolio from getting obliterated? Let’s explore when and how selling in-the-money vs out-of-the-money calls can be the umbrella on rainy days.

Using Covered Calls in a Bearish Environment

Most folks tend to lean towards selling out-of-the-money (OTM) covered calls when they’re feeling bullish. It’s a bit like betting on your favourite horse to win—you’re hoping the value of your stock gallops upwards.

But what happens when the market starts to look like a rainy day at the races and you’re feeling bearish? Can you still make a quid or at least avoid diving into the red by selling covered calls as the market tumbles? Let’s take a closer look at what unfolds when we sell OTM calls versus in-the-money (ITM) calls in this less-than-rosy environment.

The strategy changes dramatically in a bearish climate. It’s going to be pretty tough trying to keep up with sharp losses using just out of the money covered calls — the premium you collect most of the time won’t be enough to offset the losses you accumulate in the underlying.

In contrast, selling ITM calls offers a better shield for your LEAPS position. Although it might seem like a bit of a gamble, it can minimize potential losses more effectively than you’d expect from OTM calls when stocks are throwing a wobbly.

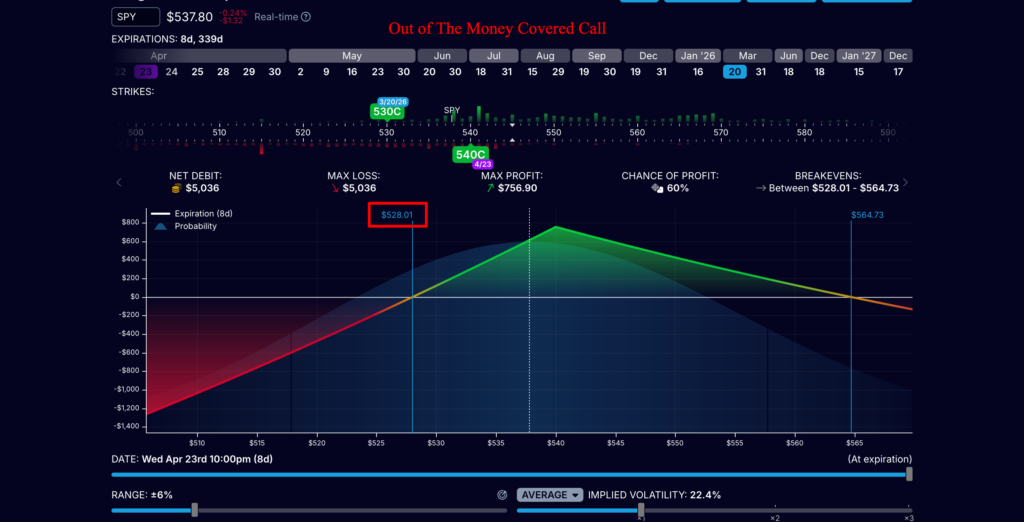

Check these two examples to see what I’m talking about:

Explaining ITM vs OTM: The Right Environment for Each

OTM calls are your best friends when you expect the market to shoot up. They let you pocket premium from selling calls without risking having to sell your shares, as long as the stock’s price stays under the strike price. It’s a lovely setup if you believe your long position will fatten up over time. But watch out —there’s downside risk that can bite you in the arse…

The major downside of OTM calls is that when the market moves down, your underlying is going to lose more than if you had sold an ITM call.

In the world of ITM calls, the landscape is a bit different. These options come with a higher premium, and it’s crucial to distinguish between the intrinsic and extrinsic value of these calls. Think of the intrinsic value as a borrowed amount, reflecting the difference the stock price is above the call strike price. Meanwhile, the extrinsic value is the premium you’ll bank no matter how the market twirls. While both OTM and ITM options bring the same extrinsic value to the table, in a downward market spiral, ITM calls hold their ground much firmer.

Projecting Results: How In The Money Calls Make You Money

Let’s rewind the clock eight weeks to the chaotic tariff confusion that shook the markets. For those tracking the spreadsheets on OTM and ITM calls, the stark contrast in outcomes was telling. The OTM calls found themselves in hot water, while the ITM calls took a bow with more composure. Although we can’t predict exactly where the market will prance the next week, hindsight can be a wonderful yet humbling thing.

Even when the market is flaunting its bullish feathers, ITM calls can make sense. Sure, your gains might be capped since your underlying position doesn’t have the room to dance upwards, but your extrinsic value will consistently line your coffers. Check out this graph that paints a clear picture of the profit zone comparison between an OTM and an ITM poor man’s covered call.

Covered Call Mindset: Steady Gains or Growth?

Many investors sell OTM calls driven by bullish optimism on a stock. But what if you were to embrace the weekly extrinsic income as your primary win and zero in on the bigger picture of your overall portfolio? It demands a shift in mindset from sunny optimism to a more grounded realism.

The realist takes comfort in the weekly extrinsic income, with confidence that it’ll eventually overshadow the total value of the underlying LEAPS position. And the cherry on top? Your position is cushioned from steep downward movements. So, while the strategy might appear pedestrian on the surface, it’s steadily building a robust income over the long haul. That’s a sturdy shelter amid the stormy market seas.