It’s been scary out there : How my covered call strategy has fared during Trump’s tariff confusion

Ever feel like the market is playing a game of tag—and you’re always “it”? That’s exactly how I felt when my portfolio started to nosedive, and continued to decline over the last couple of months. The tariff uncertainty has definitely spooked the market, and just as I was saving up to buy a new house.

So how did I keep my cool, protect my LEAPS, and still walk away with weekly income? Stick around and I’ll walk you through the recent rollercoaster with covered calls, semiconductor bets, and a dollar-cost-averaging twist you might not see coming.

Woah, what happened: A recap of the last market rollercoaster

With the S&P 500, QQQ, and IWM all riding sky-high before the upheaval, it was like we were all cruising along at full speed. After Trump was elected, there was a huge boost to the market. Then, somewhat out of the blue, tariffs started causing some major discontent in the market, leading to widespread uncertainty that sent even the most seasoned traders scrambling for cover.

What kicked off as a modest 5% dip spiraled into a serious 10% market correction. And just when we thought things couldn’t get any worse, talk of a bear market started doing the rounds.

Yep, market drawdowns can be pretty terrifying. Watching your LEAPS – long-term equity anticipation securities for the uninitiated – take a nosedive wasn’t easy. Not just any nosedive, but one that makes you rethink your entire strategy. Since I’m on the brink of buying a new place, I had to rethink fast. I bit the bullet and decided to cut my losses because, as is always the case in these situations – I needed more cash on hand than I’d initially anticipated.

The good, the bad and the ugly: My saga with semiconductors

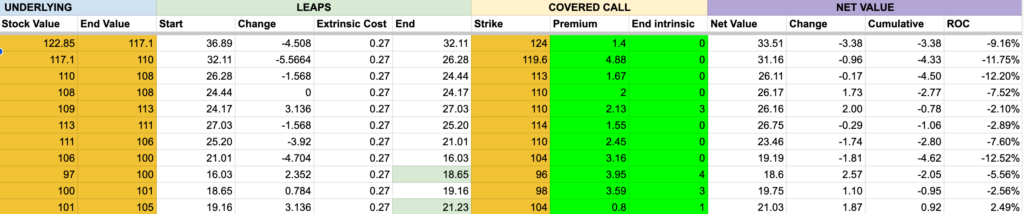

Now, if there’s one industry that keeps you on your toes, it’s semiconductors. My trades with AMD and AMAT were something of a rollercoaster. Despite the market chaos and a hefty drawdown, these trades managed to come through without wreaking much havoc. Just goes to show, even when the chips are down, some trades surprise you.

Over a 7 week period, AMD declined by 20% in value. Yet, the return on capital was actually -2.5%. Were I to have held the shares, they would have been worth 20% less, but my LEAPS only declined a small amount beacuse I was selling weekly covered calls to protect my position.

In fact, by week 8 as the shares climbed up to $105, the position was actually profitable despite experiencing overall a 14% decline.

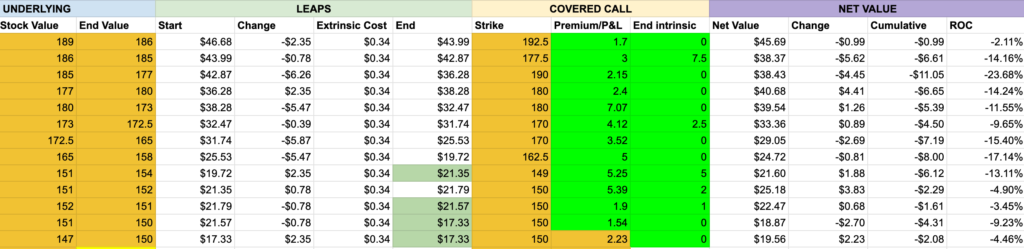

AMAT did something simliar- declining from $189 to $150 (I bought my LEAPS at the top, it seems) representing a $3800 loss if I were to have bought shares. But the total loss using my strategy was only $208. While the LEAPS value declined from $46.68 to $17.33, it was mostly offset by the premium I collected over those 8 weeks.

NVDA LEAPS and the Whipsaw Effect

NVDA wasn’t quite so forgiving. At first, It went up, then down, then up again – it was all quite a frenzy. I mean, it’s exciting but also nerve-wracking! In light of the rocky ride, I shut most of these positions, anticipating that the market might drop further. As the old adage goes – know when to hold ’em, know when to fold ’em.

NVIDIA was 40% off its highs trading at $100 per share, I decided to quit the position reasoning that if we declined further, my LEAPS would lose even more money and I would be constnatly playing catch-up.

Nvidia did pretty well to begin with when the underlying shares went up from $126 to $136 – at that point I Was 30% up on the position. But quickly deteriorated as uncertainty around trading with China and exports took hold.

And this is an issue with the style of trading I do – if the stock goes up, my short call loses value but the long one increases. But if the following week the opposite happens, I am not necessarily better off. A “whipsaw” effect can really mess up my trades.

The best solution I’ve found is to sell at-the-money calls and just think about collecting the extrinsic value.

The trades I’m keeping – and dollar-cost-averaging

Dollar-cost-averaging (DCA) isn’t just for stock, you know. I took a punt and started DCA-ing Google calls. The only issue is that my Google long LEAPS are now in the money, and so it requires margin to sell calls against them. But the same principle stands – if the underlying goes up, my LEAPS value increases (and partly offset by the short calls going in the money). If it goes down, I get to keep the weekly premium I sell.

I’m still holding onto some long calls with Google and NVIDIA because I’m bullish on both. With volatility running high, it’s payday every week; I’m looking at about $200 per week per contract. So for purchasing my 4 LEAPS with a total value of around $9000 I am currently getting $800 per week in extrinsic value.

Think about it – if my short calls go in the money, my LEAPS value goes up. And I still get to keep that $800 in extrinsic value (deducted from the ITM value). If the stock price goes down, I just keep the $800. That means in 12 weeks, the LEAPS value will have been recuperated.

So I’m on a mission to prove that, even amidst the chaos, LEAPS can pay off in a relatively short amount of time. I’ll be keeping you updated on how that pans out. It’s all part of the learning curve.

Conclusion: Wrapping it all up with DCA magic

So, can you really dollar-cost-average even when the market takes a nosedive?

Absolutely. When the market dips, this strategy really shines by protecting your LEAPS, especially if you’re selling in-the-money (ITM) calls. This safety net is pretty handy.

If you’re confident the market will rebound within the lifetime of the LEAPS contract, then why not buy more contracts as the price of the LEAPS decreases? Add to your position, and you can average the price of each LEAPS.

The fatal mistake I made – as I’m sure countless others have – is to be overinvested. If I had been prepared only to lose $10k, I should have stopped buying LEAPS when I’d bought $10k’s worth. The problem was that I got excited and put more and more cash into these positions. If all my LEAPS had gone to $0, I would have been short cash for my property purchase.

This whole experience has been a cracking test of the theory that LEAPS can eventually be paid off, reducing the associated risk to zilch – even during long, drawn-out drawdown periods. It’s a journey and a half, but a fascinating one, and I’m eager to continue sharing what I learn along the way.

Here’s to finding alternative ways to earn income and embracing the twists and turns of investing beyond traditional ETFs. Onwards and upwards!